Ohio residents can deduct up to $4,000 per beneficiary per year on their state taxes. Oklahoma allows individuals to deduct up to $10,000 per year and joint filers to deduct up to $20,000. Oregon gives a tax credit for 529 contributions. The credit is up to $300 for joint filers and up to $150 for individuals.

529 College Savings Plans: All 50 States Tax Benefit Comparison (Updated 2023) — My Money Blog

Here are the special tax benefits and considerations for using a 529 plan in California. Contributions. California does not offer any tax deductions for contributing to a 529 plan. Minimum: There is no minimum contribution. Maximum: Accepts contributions until all account balances for the same beneficiary reach $529,000.

Source Image: financialplanningassociation.org

Download Image

If you use funds from a California 529 plan account for non-qualified purposes, the earnings portion of withdrawals will be taxed as ordinary income and may be subject to a 10% additional federal tax as well as a 2.5% additional income tax in California. You can open a California 529 plan account and name as beneficiary your child, your

Source Image: chase.com

Download Image

Best 529 Plans of 2023: Your Complete Guide | The Motley Fool How Our 529 Works. 1 Withdrawals for tuition expenses at a public, private or religious elementary, middle, or high school can be withdrawn free from federal tax. For California taxpayers these withdrawals are subject to state income tax and an additional 2.5% California tax. Withdrawals for registered apprenticeship programs and student loans

Source Image: scholarshare529.com

Download Image

Are Contributions To 529 Plans Tax Deductible In California

How Our 529 Works. 1 Withdrawals for tuition expenses at a public, private or religious elementary, middle, or high school can be withdrawn free from federal tax. For California taxpayers these withdrawals are subject to state income tax and an additional 2.5% California tax. Withdrawals for registered apprenticeship programs and student loans Contributions to California 529 plans are made with after-tax dollars, similar to a Roth IRA. Contributions to California 529 plans are not deductible on federal or California state income tax returns. California is one of the few states with a state income tax that does not allow state income tax deductions or tax credits on contributions to

How Does A 529 Plan Work In California?

No Tax Deduction. While California’s 529 plan is a good one, California is one of seven states with an income tax system that does not allow tax deductions for contributions. There’s no limit on 529 vs. UTMA: Which College Savings Plan Is Right for You? – Physician on FIRE

Source Image: physicianonfire.com

Download Image

529 Plan Interactive Comparison Map and Tax Deduction Calculator — My Money Blog No Tax Deduction. While California’s 529 plan is a good one, California is one of seven states with an income tax system that does not allow tax deductions for contributions. There’s no limit on

Source Image: mymoneyblog.com

Download Image

529 College Savings Plans: All 50 States Tax Benefit Comparison (Updated 2023) — My Money Blog Ohio residents can deduct up to $4,000 per beneficiary per year on their state taxes. Oklahoma allows individuals to deduct up to $10,000 per year and joint filers to deduct up to $20,000. Oregon gives a tax credit for 529 contributions. The credit is up to $300 for joint filers and up to $150 for individuals.

Source Image: mymoneyblog.com

Download Image

Best 529 Plans of 2023: Your Complete Guide | The Motley Fool If you use funds from a California 529 plan account for non-qualified purposes, the earnings portion of withdrawals will be taxed as ordinary income and may be subject to a 10% additional federal tax as well as a 2.5% additional income tax in California. You can open a California 529 plan account and name as beneficiary your child, your

Source Image: fool.com

Download Image

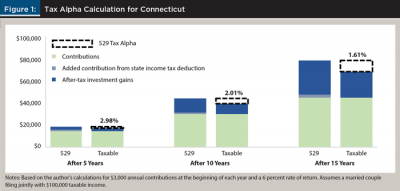

What States Allow Tax Deductions For 529 Contributions? 529 contributions are tax deductible on the state level in some states. They are not tax deductible on the federal level. But if you’re saving for college, you’ll want to know that 529 savings plans offer other tax benefits, such as tax-free earnings growth and tax-free withdrawals for qualified expenses. These tax-savings vehicles might

Source Image: thecollegeinvestor.com

Download Image

Dynasty 529 Plan For Multigenerational College Expenses How Our 529 Works. 1 Withdrawals for tuition expenses at a public, private or religious elementary, middle, or high school can be withdrawn free from federal tax. For California taxpayers these withdrawals are subject to state income tax and an additional 2.5% California tax. Withdrawals for registered apprenticeship programs and student loans

Source Image: kitces.com

Download Image

Tax Advantages of 529 Plans Contributions to California 529 plans are made with after-tax dollars, similar to a Roth IRA. Contributions to California 529 plans are not deductible on federal or California state income tax returns. California is one of the few states with a state income tax that does not allow state income tax deductions or tax credits on contributions to

Source Image: collegeaccess529.com

Download Image

529 Plan Interactive Comparison Map and Tax Deduction Calculator — My Money Blog

Tax Advantages of 529 Plans Here are the special tax benefits and considerations for using a 529 plan in California. Contributions. California does not offer any tax deductions for contributing to a 529 plan. Minimum: There is no minimum contribution. Maximum: Accepts contributions until all account balances for the same beneficiary reach $529,000.

Best 529 Plans of 2023: Your Complete Guide | The Motley Fool Dynasty 529 Plan For Multigenerational College Expenses 529 contributions are tax deductible on the state level in some states. They are not tax deductible on the federal level. But if you’re saving for college, you’ll want to know that 529 savings plans offer other tax benefits, such as tax-free earnings growth and tax-free withdrawals for qualified expenses. These tax-savings vehicles might